December 16, 2025

In partnership with

Market leaders create a specific kind of gravity.

They pull you into their orbit. You copy their features, match their pricing, and adopt their tone because it feels safe. By imitating the leader, you signal reliability. In your mind, that is.

For your customers, this only invokes one word. “Knockoff.”

True growth comes from friction. It comes from standing in opposition to the status quo.

By definition, this is known as counter-positioning.

Instead of a direct fight with Goliath, it allows you to dictate the terms of engagement. To turn the competitor’s brand, operations, and reputation into a disadvantage.

Sponsored

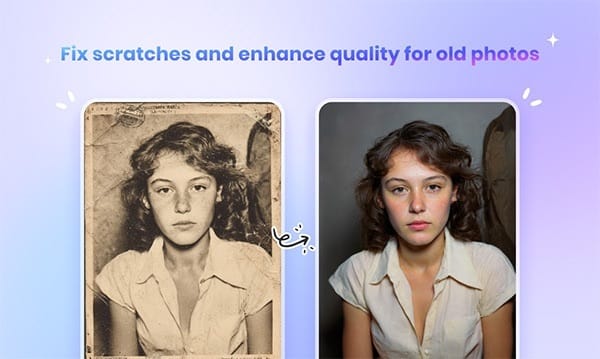

Bring old memories back to life

Your cherished old photos deserve a second chance!

PicWish uses AI to eliminate damage, boost color, and sharpen faces. Relive your favorite moments in crystal-clear quality.

Weekly Insight

In 2002, Red Bull seemed invincible. They owned nearly 100% of the energy drink market with a premium, sleek, European product.

Everyone tried to copy them, launching their own slim, silver cans of similar-tasting go-go juice. They tried, and they failed.

Then came the Monster under Red Bull’s bed.

Monster Energy came in with a totally different strategy. Rather than trying to be ‘Red Bull but better,’ they completely ignored the premium game.

Red Bull = 8oz, expensive, "European," focused on activities (skiing, F1).

Monster = 16oz, same price, "American," focused on lifestyle (gaming, punk rock).

Monster’s pitch wasn't “we are premium.” Rather, it was: “Red Bull’s a pretentious rip-off product for rich people. Here’s double the energy for the same price.”

They took everything that Red Bull built themselves up to be — premium, sleek, luxurious — and positioned it as a weakness. Instead of criticizing them for what they weren’t, they criticized them for what they were. What made them, them.

In doing so, Monster birthed an entirely new, identity-based segment in the energy drink market. And, of course, grew into a $70+ billion giant in the process.

When thinking about this, I realized Liquid Death repeated the exact play in 2019.

The bottled water market sold purity. Dasani and Evian evoked images of mountains and glaciers. Of cleanliness and health.

Liquid Death’s founder, Mike Cessario, went the other way. He promised murder.

They packaged water in tallboy beer cans. Marketed to heavy metal fans and skaters. Played up the ridiculousness of the whole thing to make hydration funny and aggressive. In doing so, he transformed “cleanliness and health” into “boring and corporate.”

Liquid Death’s product is not special. But that didn’t stop them from reaching a $1.4 billion valuation in 2024.

Now, I don’t mean to just go on about beverage brands. There are myriad examples of this outside the consumer-packaged-goods space (Netflix, Dell, Vanguard, etc.). But these examples are so ridiculous that they’re great.

They prove that distinct value creates market share. You can’t “out-Amazon” Amazon. You can’t “out-Facebook” Facebook. If you try to be better than the leader, you lose. You have to be different than them, in a way they can’t copy.

📚 Related Reading

Quickstart guide to positioning (April Dunford)

More comprehensive overview on the topic of positioning, in general. Explains the base concept of going from messaging to positioning, and how to do it in a way your customers connect with.7 Powers: the foundations of business strategy by Hamilton Helmer (Abi Tyas Tunggal)

A recap of the book that first defined the concept of counter-positioning. Ironically, I included this piece, then heard it referenced by the hosts of the Acquired podcast the next day. Confirmed: it’s valuable.Semrush got their exit, maybe it’s time for yours (Ahrefs)

A great recent example of counter-positioning from the SEO tool, Ahrefs. Their competitor, Semrush, got acquired by Adobe. Ahrefs used this as an opportunity to steal some customers.

Intent to Action

Counter-positioning starts by finding something your most successful competitor does, which is inextricably linked to their brand, that not all customers like. Then you blow that issue the heck up.

I call it a Hate Audit.

It begins the same way as classic review mining: you identify the undisputed leader in your category. You need a target with a clearly defined brand, because you’re going to use their reputation as a fulcrum.

Once you have your target, write down their greatest virtues. These are the traits they list on their homepage and the reasons they win enterprise contracts. It might be things like “robust features” or “premium status.”

Every virtue casts a shadow

Your job is to find the downside of that strength. If the leader is “robust,” the shadow is often “bloated and complicated.” If they’re “premium,” the shadow is “overpriced and exclusionary.”

You’re looking for the inevitable consequence of their success.

Validate this intuition with data. Visit G2 (B2B SaaS), Capterra (all SaaS), or Amazon (B2C) and filter the leader's reviews by 1-star. Look for patterns.

You’ll find that customers rarely complain about the product breaking. They complain about the nature of the product. They will confirm that the “robust features” feel overwhelming or the “white-glove service” feels intrusive.

This is your opening.

Draft your position by unapologetically stating the opposite. “Unlike [Leader] who is [Virtue], we are [Opposite] for [Customer Segment].”

Where Salesforce offers “robust customization for the enterprise,” Basecamp counters with “simple software for teams who hate bloated tech.”

Where Gillette offers “the most advanced shaving technology in the world,” Dollar Shave Club counters with “it’s a razor and it works. Stop overpaying.”

You don’t need to be better at their game. As the little guy, you can just take advantage of the annoyance their game creates.

You do not merely want to be considered the best of the best. You want to be considered the only ones that do what you do.

Sponsored

Shoppers are adding to cart for the holidays

Over the next year, Roku predicts that 100% of the streaming audience will see ads. For growth marketers in 2026, CTV will remain an important “safe space” as AI creates widespread disruption in the search and social channels. Plus, easier access to self-serve CTV ad buying tools and targeting options will lead to a surge in locally-targeted streaming campaigns.

Read our guide to find out why growth marketers should make sure CTV is part of their 2026 media mix.

Toolbox 🧰

Pollfish | A quick survey tool that lets you test your new counter-positioning angle on real people, to see if it resonates.

GummySearch | Everyone checks Google, but the real unfiltered opinions are on Reddit. This tool lets you scan specific communities (e.g., r/sales, r/marketing) to find exactly what people are complaining about regarding your competitors.

Owletter | You can’t counter-position against a message you don’t see. This tool captures every email your competitors send and stores them in a searchable database. It allows you to analyze their lifecycle emails and spot the boring “corporate” patterns you can disrupt.